5 Reasons An Offshore Financial Institution May Be Best For Your Banking Needs

Published May 1st, 2023.

Offshore banks are financial institutions located outside a person's country of residence. These banks provide a range of services, including banking, investment management, and other financial products.

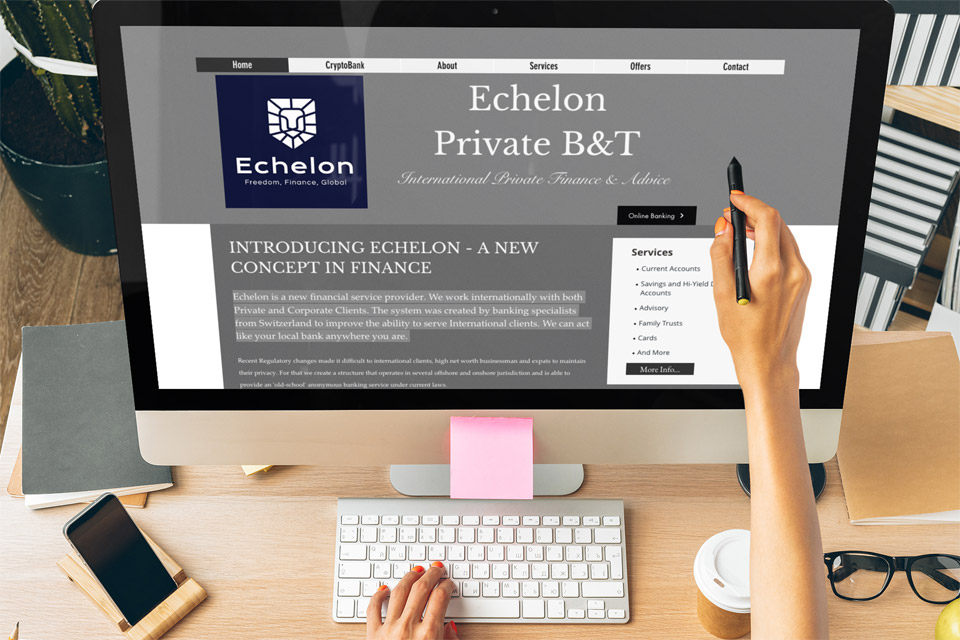

Echelon PBT (Private Bank and Trust) offers the highest level of privacy and secrecy. Many offshore banks offer anonymous accounts, which help to protect the identity of the account holder, but at Echelon, we added several additional layers of protection. Stemming from the old Swiss Banking numbered account system and integrated with the latest cutting-edge technology.

There are various benefits of using discrete offshore banking, and some of these benefits are:

1. Privacy and Security

Offshore banks are known for their high level of confidentiality and privacy. Many offshore jurisdictions have strict privacy laws that make it difficult for third parties, including government agencies, to access information about accounts and transactions.

Discrete offshore banking can help protect the identity and assets of individuals exposed to risks in their home country.

2. Asset Protection

Offshore banks can offer exceptional asset protection. Assets that are held offshore are often protected from lawsuits, creditors, and other legal judgments.

Additionally, offshore banks offer greater flexibility and diversity in investment opportunities, as they tend to have fewer restrictions and higher returns.

3. Reduced Tax Liability

One of the most significant advantages of offshore banking is the potential for reduced tax liability. Certain offshore jurisdictions have lower taxes or no taxes on foreign-owned assets. This makes offshore banking particularly attractive to high-net-worth individuals looking to minimize their tax burden..

4. Currency Diversification

Offshore banks can help manage currency risks. For example, if an individual lives in a country with a volatile currency, they may choose to hold some of their assets in a stable currency such as the US dollar, Euro, or Swiss franc.

This can provide a level of protection against currency fluctuations. At Echelon, we also offer CryptoBanking Services and enable clients to make deposits using certain Cryptocurrencies.

5. Privacy in Estate Planning

Offshore banking can also be useful in estate planning by providing greater privacy and protection for assets that are intended to be passed down to future generations. This can help to reduce the risk of family disputes and protect the assets from potential creditors.

About The Echelon Advantage

Given the above stated and adding to it, at Echelon PBT, not only do our clients enjoy all the benefits of offshore baking, but they are also doing so with reliability and accessibility.

Each client, upon account setup receives a personal Account Manager (“AM”) who will always be accessible and reachable to assist with all the client’s needs.

At Echelon, we are selective with our clients and acceptance is not based only on account size, but we prefer also to evaluate the type and quality of our clients and their growth potential.

The Echelon PBT Asset Management Team specializes in customizing a portfolio for each client based on the determining factors or the client’s objectives.

Echelon PBT teamed up with the world’s best private equity fund management companies, and this means our clients can access local investments in literally every major industry and any major geographical location.

Recently we at Echelon signed a partnership with the world’s leading Natural Resources Exploration investment management company and entered a USD 75 million investment in the growing Lithium mining sector. The Lithium Sector is now the new Gold Rush and Echelon we enable our clients to enjoy accessibility to this incredible opportunity.

Self Managed Accounts

At Echelon Private Bank and Trust, we are proud to offer Self-managed Accounts (to clients who meet certain criteria). Self Managed accounts are accounts that are from the set-up to the operation phase all made and arranged by the client.

From the types of currencies to services. The client registers and uploads the required and relevant ID and other documents and upon approval has the free hand to operate freely as he/she sees fit.

These accounts as well as others have specific requirements. Below is a list of requirements and fees associated with opening accounts with Echelon Private Bank and Trust (fees are quoted in Euros):

| Account Type | Minimum Deposit | Fees (annual) |

|---|---|---|

| Common | € 10,000.00 | €100 |

| Plus | €100,000.00 | €80 |

| Super | €250,000.00 | €30 |

| VIP | €500,000.00 | €0 |

| SuperVIP | €1,000,000.00 | €0 |

| Self Guided Common | €50,000.00 | €80 |

| CryptoBankPlus | €250,000.00 | €50 |

| CryptoBankVIP | €1,000,000.00 | €0 |

All accounts have certain deposits, locked deposits and other requirements.

Our clients enjoy the highest degree of anonymity and utilize our special IDP clearing services. We also offer to qualified clients credit card services.

We are looking forward to assisting you with your global banking needs.