Improve Your Business With Payroll Services

Payroll is an important part of any business, large or small. After all, if your staff are not paid correctly and on time, they are unlikely to remain your staff for very long – but it can prove to be a bit of a headache. Luckily, the growing numbers of companies offering payroll services means that you no longer have to manage this yourself.

Some organisations are reluctant to outsource their payroll, often due to a misplaced belief that doing it in-house is more cost-effective, or due to a nervousness about sharing data with an external company. In actual fact, outsourcing this crucial business function to an accountant can be a great move for your business.

Cost savings

While some businesses choose to keep their payroll in-house in order to save money, using external payroll services can prove to be very cost-effective. In the first instance, if processing in-house, you will need to pay out for payroll software and also pay ongoing annual maintenance or subscription charges. A survey by ADP estimated that the average annual cost of maintaining software, plus administration, can be as much as £104,280 (based on approximately 1,000 payslips a month).

And then there is the issue of staff time – both in terms of being trained to use a payroll system and in terms of processing payments each month. This can take up a large chunk of your employees’ time, especially as your business grows, and is not always the most efficient option for your business. By outsourcing this function, your staff have more time to focus on your core business.

Better security

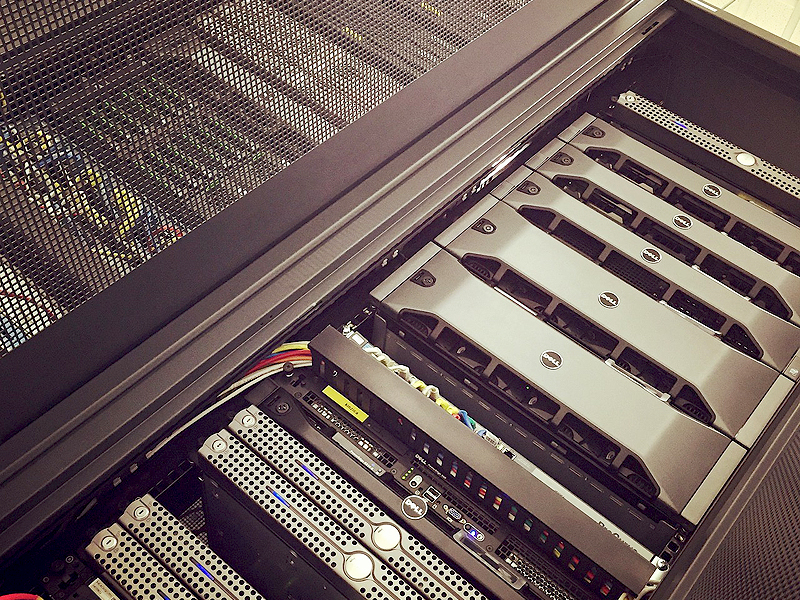

A common concern for many companies when using an external firm to administer the payroll, is security of data. However, sensitive information is held off site on secure servers, with password protection and back-up facilities, often making it a much more secure option than your internal systems.

Professional expertise

Professional expertise

Payroll is complicated and bound by lots of regulations around tax deduction, record keeping, payments to HMRC, to name just a few. Keeping up with the changing legislation can be difficult and mistakes or non-compliance can lead to costly penalties for your business.

By using external services, your payroll will be in the hands of a professional accountant who will be aware of any developments or changes to payroll legislation, leaving you less open to non-compliance. If mistakes are made by your payroll company, you can seek reimbursement for any costs incurred as a result.

Reduce risks

In many smaller businesses, the responsibility for the payroll sits with just one member of staff. This is a big risk – leaving you vulnerable to unexpected absence due to sickness for example.Transferring responsibility to members of staff who are unfamiliar with the system could lead to mistakes being made which, in turn, could lead to staff not being paid or penalties for non-compliance. Outsourcing your payroll removes that risk.

Far from being a large cost for your business, payroll services can bring many benefits – crucially, they save you money and give you peace of mind. It’s important to do some research to find the accountant that best fits your needs, but once you’ve found a professional who you feel you can trust, you can outsource all of your payroll duties to them while you get on with the important task of growing your business!

Linda Carr is the Founder of Linda Carr Accountants, a Chartered Certified Firm of accountants based in Peterborough, which was established in 2009. Linda recognises the need for SME’s to be able to access a reliable accountants for an affordable price.