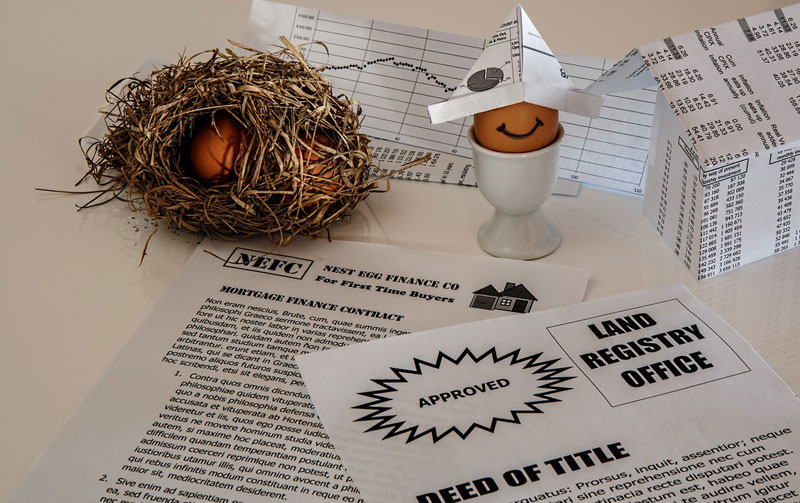

Mortgages not only for those with resident status in Canada

New arrivals to Canada don’t have to miss out when it comes to getting a mortgage and buying a home.

One common misconception is that mortgages are only available for those with resident status in Canada – either permanent resident or citizen. This is wrong.

Non-residents are also eligible to apply for mortgage loans and get the house of their dreams.

What this means is that those who live and are residents of other countries don’t have to say no to the thought of acquiring a home in Canada.

When they do move to acquire a residence here, they aren’t left with limited options when it comes to financing.

Instead, they can be eligible for a mortgage loan, same as Canadian permanent residents and citizens.

This isn’t just an academic question. In fact, many houses in Canada are owned by people who do not reside here.

If you think about it, this makes sense. Lots of people own houses in other countries, often acting as vacation properties. Looking at this another way, think of those Canadians who buy homes in warm-weather winter-getaway spots, such as Florida.

Some lenders will have qualifications for non-residents, however. These can include restrictions on the amount of the home’s value that the mortgage can finance. An example here are pure vacation properties, such as cottages. Some lenders will restrict mortgages for cottage vacation properties to 50% of the property’s value says real estate startup OwnUp.

If a non-resident is looking to buy a house here to live in regularly – and not visit for a few vacation-friendly points in the year – then the mortgage loan terms can be a bit looser, offering a higher loan versus the value of the property a mortgage wants to buy.

What this process entails is the same level of scrutiny as Canadian-residing mortgage applicants. This means that your international credit history will be examined via an Equifax credit check. The status of your assets will also be checked, the home you want to buy will be appraised, and your general financial shape – such as your employment status and income – will also be looked over.

Just as for citizens and permanent residents in Canada, there are definitely some pointers that non-resident mortgage applicants can follow to improve the odds of getting that mortgage application approved.

One key step here, if it wasn’t obvious already, is to get your credit history in good shape. This means maximizing your credit rating, so that when it is looked over it doesn’t cause any problems or flag you as a possible credit risk. A healthy and strong credit rating will also ensure you get the best terms for your mortgage – benefits that can actually save you money.

Make sure you’re making regular payments against your credit cards and any automobile loans. Don’t neglect to use your card – that can also negatively impact your credit score. Rather, use it regularly and pay it off regularly – that way you’ll be in the best shape when it comes to your credit rating.

I am Eric Jones, a businessman by profession. Business and entrepreneurship are my passion and I love researching on the various aspects of those areas. I make sure that I don’t miss out any updates and for this reason I read quite a lot. Law is yet another area which I am passionate to know more about.

You may also be interested in:

Expat banking in Canada.

Express Entry helps foreign nationals moving to Canada

We would love to hear from you about your experience as an expat with mortgages in Canada.